Claims departments are under pressure: rising case numbers, complex procedures, scarce resources. Those who still process cases manually or semi-automatically not only lose time, but also control, quality, and money.

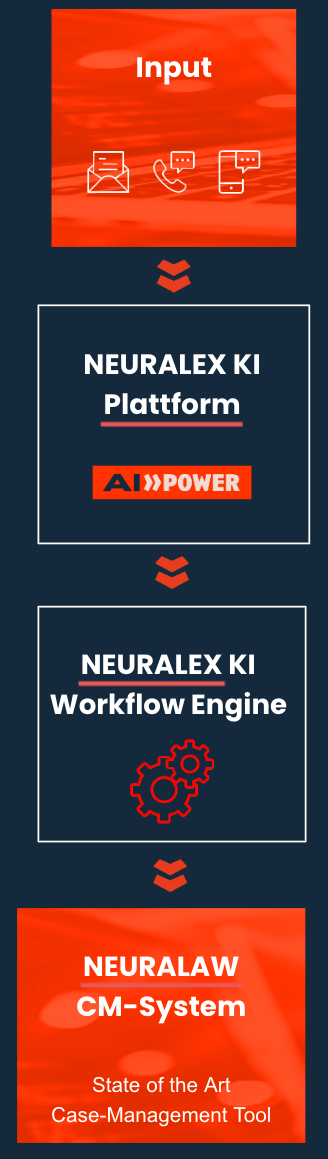

Our AI-powered platform enables law firms, insurers, and mobility providers to intelligently structure and automate their claims workflows from document recognition and data extraction to complete end-to-end automation.

All in one place. Fully AI-driven. Always available.

Efficient. Scalable. Surprisingly cost effective.

Curious how NEURALEX can work for your organization?

See NEURALEX in action book your demo now

Key Advantages at a Glance

Key Advantages at a GlanceNEURALEX is more than a tool, it is a complete system that digitally supports you from the lead all the way to case closure:

• Intelligent email and document recognition.

• Automated data extraction.

• Deadline management

• Case based communication.

• Document creation.

• Fully automated workflows & task control.

• Integrated invoicing, payment tracking & accounting.

• Chatbots, call agents, and proactive client handling.

• Cloud, private cloud, or on premise options.

• GDPR compliant & prepared for SOC2 / ISO27001.

specialized in traffic/insurance

Composite/TPA

OEM/Bank/independent

national/international

• beA integration with auto assignment & deadline reminders, incoming/outgoing mail directly in the case file, no media disruptions.

• Automatic document intake & file creation, new cases are detected, structured, and clearly named.

• Deadline & appointment management with escalation audit-proof, “nothing gets lost”.

• Generator for claims and billing letters prefilled from extracted data, CI-compliant.

• Data extraction & categorization (repair invoice, expert opinion, rental car, etc.) saves manual checking.

• Litigation support , document bundles, pleading assists, rapid dossier preparation.

• Client status updates (bot) fewer inquiries, higher satisfaction.

• FNOL automation and automatic case creation – faster initial processing, fewer manual touchpoints

• Triage and prioritization based on rules, coverage, and dispute value – the right cases to the right team.

• Data extraction from invoices and expert reports – reliable decision-making within seconds.

• Automatic forwarding of documents (e.g. rental car invoices) – directly to review or billing.

• Standardized decision letters and payouts – consistent and auditable.

• Dashboards and KPIs (processing time, first-time-right, degree of automation) – measurable performance.

• Seamless integration into CRM, policy administration, and case management – no system change required

• Central overview per vehicle/contract client/lessee, counterparty, accident location, policies/case numbers at a glance.

• Automated mapping of return damages to asset/contract clear assignment.

• Rule set for evaluation & cost logic consistent, transparent decisions.

• Document pipeline with categorization repair, expert report, photos, billing neatly structured.

• Automatic forwarding & approvals e.g., workshop, inspection service provider, billing.

• Letters & invoices out-of-the-box prefilled, legally compliant, fast.

• SLA-driven workflows & escalations predictable processing times.

• Fast damage intake from branch/portal/email standardized recording with no extra effort.

• Document splitting, naming & tagging receipts immediately placed in the correct file/position.

• Automatic forwarding (e.g., rental car/repair invoices) to review/insurance/legal department.

• Creation of claims and billing letters quick cost recovery.

• Communication with workshop/expert via templates fewer queries, clear to dos.

• Transparent timeline & KPIs status clearly visible for back office/branches.

• Optional beA integration for legal escalations.

Neuralex Deutschland GmbH

Demo & Consultation:

Hagen Zauft

hagen.zauft@neuralex.ai

+49 170 3343784